Blog –

1 minute read

PACER Data Now Integrated into Vcheck’s Monitoring Providing Real-time Access to Federal Civil, Criminal, and Bankruptcy Filings

Blog –

6 minute read

A Preview Of The Outbound Investment Regime

Blog –

8 minute read

E.U. & U.K. Due Diligence Challenges: International Due Diligence Guide

Blog –

5 minute read

Preventing SMB Lending Fraud Through ID Verification

Blog –

9 minute read

All You Need to Know About Politically Exposed Persons

Blog –

5 minute read

Fund Manager Due Diligence, Fraud, and Emerging Risk

Blog –

9 minute read

ID Verification & Risk Mitigation: A Guide

All Posts

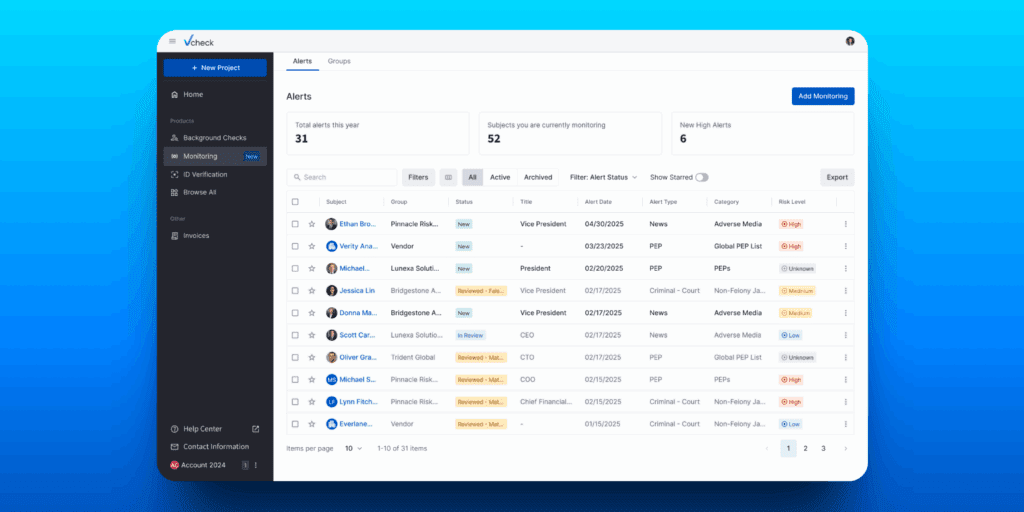

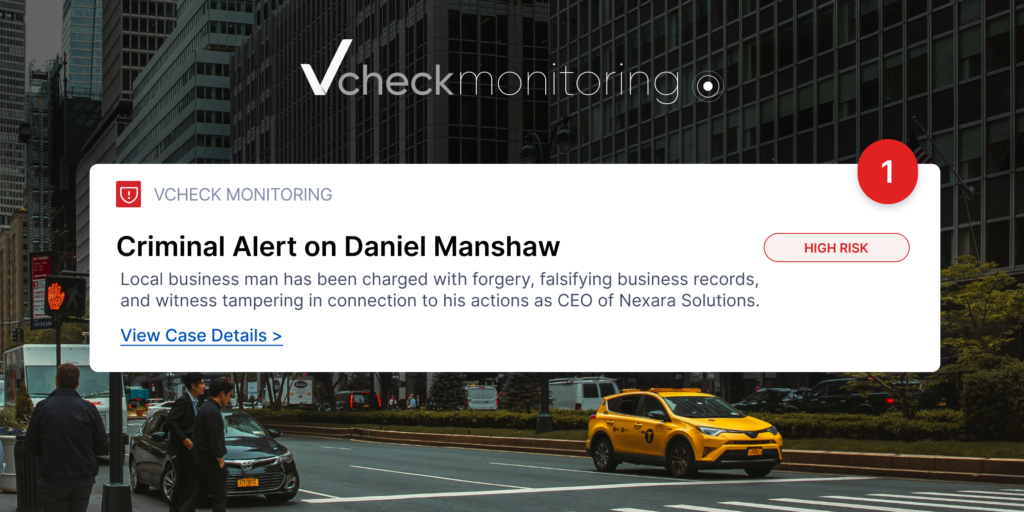

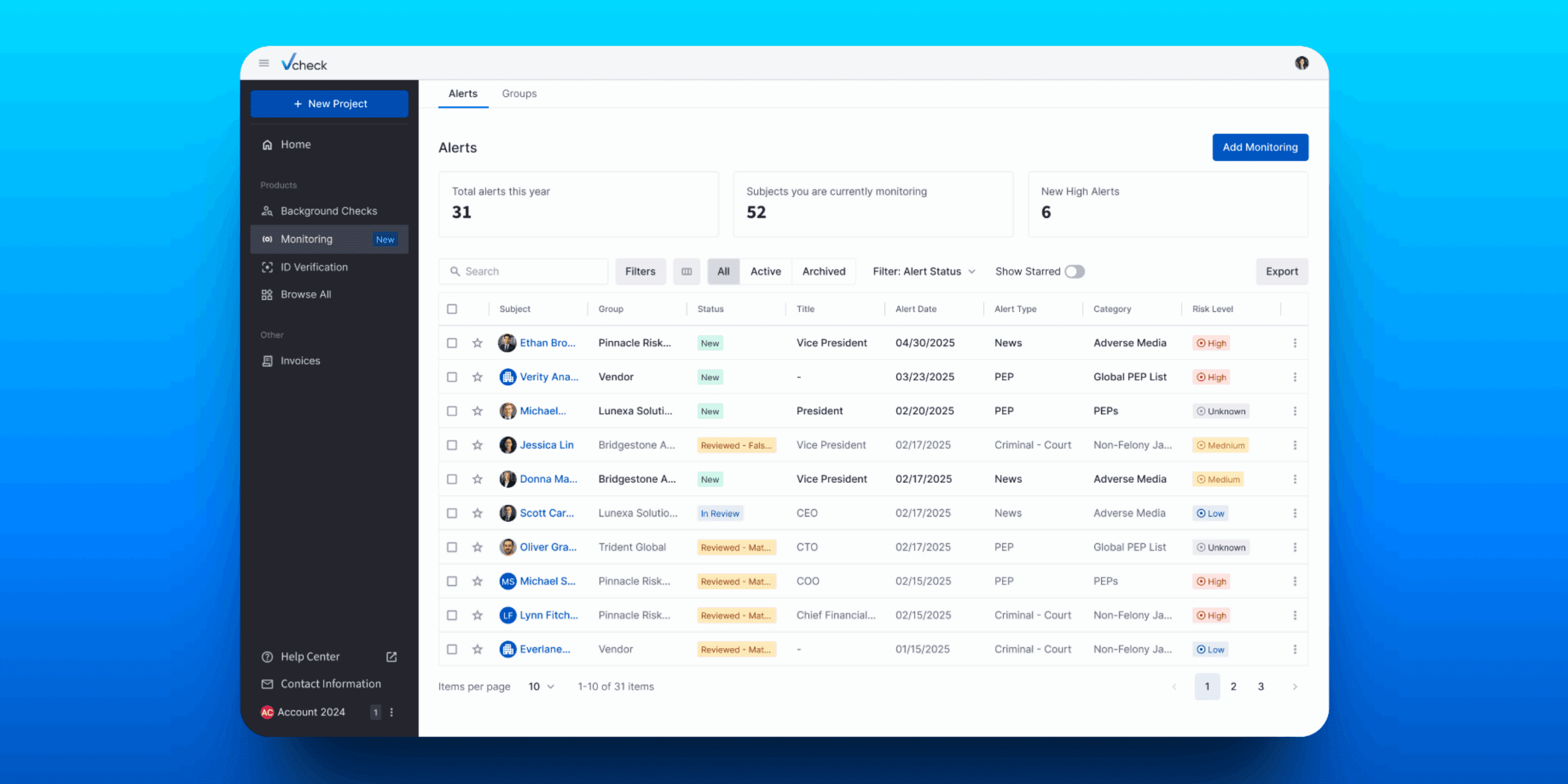

How Vcheck’s Portfolio Monitoring Instantly Alerted PE Firm of PortCo CEO’s Hit-and-Run Charge A growing private equity firm needed ongoing, real-time insights into legal and reputational risks across its portfolio companies and executives, including pending litigation, criminal histories, and adverse media coverage.

How Vcheck’s Portfolio Monitoring Instantly Alerted PE Firm of PortCo CEO’s Hit-and-Run Charge A growing private equity firm needed ongoing, real-time insights into legal and reputational risks across its portfolio companies and executives, including pending litigation, criminal histories, and adverse media coverage.  How Vcheck Exposed Organized Crime Links Behind a Regional Bank’s Planned IPO An investment bank engaged Vcheck to investigate the legal and reputational risks of a rapidly expanding regional digital bank in South America prior to underwriting their IPO. As an underwriter, the investment bank needed assurance that the IPO would not be undermined by reputational or political risks and that all necessary litigation, legal risks, and regulatory issues were identified prior to filing the S-1.

How Vcheck Exposed Organized Crime Links Behind a Regional Bank’s Planned IPO An investment bank engaged Vcheck to investigate the legal and reputational risks of a rapidly expanding regional digital bank in South America prior to underwriting their IPO. As an underwriter, the investment bank needed assurance that the IPO would not be undermined by reputational or political risks and that all necessary litigation, legal risks, and regulatory issues were identified prior to filing the S-1.  How Loan Monitoring Flags Borrower Risk in Real-Time A mid-market private debt fund issued a loan to a real estate developer and needed to proactively monitor any new risks that could emerge during the life of the loan.

How Loan Monitoring Flags Borrower Risk in Real-Time A mid-market private debt fund issued a loan to a real estate developer and needed to proactively monitor any new risks that could emerge during the life of the loan.  How Vcheck Uncovered a Hidden, Expunged Homicide Charge A private equity firm was considering the acquisition of a cybersecurity company but first required deeper visibility into the legal and reputational risks of the target’s executives. View all

How Vcheck Uncovered a Hidden, Expunged Homicide Charge A private equity firm was considering the acquisition of a cybersecurity company but first required deeper visibility into the legal and reputational risks of the target’s executives. View all