ID verification is a critical part of compliance and due diligence. It allows firms to adhere to AML and KYC guidelines and protect themselves against insider threats and data breaches. According to a recent study, 80% of financial services organizations have experienced a breach related to verification and authentication weaknesses.

Worse, human error is the cause of 84% of insider and third-party threats, highlighting a significant need for more accurate forms of ID verification.

What is ID Verification?

ID verification refers to verifying and confirming an individual or organization’s identity. As a part of compliance processes, firms must verify the identities of those involved before initiating any business relationship. Document collection and confirmation, background checks, and ID verification comprise this process.

Conventional ID verification is a time-consuming task. Traditionally, ID and State driver’s license verification is conducted at the beginning of compliance processes; accuracy lies in how well the verifier makes an educated decision based on their knowledge of State IDs. Digital ID scanner technology sometimes assists the verifier, but most of these tools aren’t comprehensive.

Unfortunately, traditional, manual methods have fallen short with the rise of AI-generated images and editing tools. Most digital scanning tools can’t determine whether an ID is registered by its issuing agency, and seldom can these vetting tactics determine if an ID is real, fake, photoshopped, or AI-generated–in other words, currently, guesswork comprises much of the process.

An academic study found that traditional ID verification was only around 69% accurate and that those who work with IDs regularly (bartenders, security staff, etc.) aren’t more effective than those with minimal knowledge. Worse, fake ID usage is on the rise, with an estimated 14 million fraudulent IDs circling in the U.S. at any time.

Information storage is a concern for many U.S. firms, complicating this. Unfortunately, many companies store their ID information in archaic ways, making them susceptible to excess risk. Furthermore, cybersecurity is at the forefront of firm’s minds, with data breaches and leaks seemingly rising in recent years.

Why is ID Verification Important?

Foregoing comprehensive identity verification is risky and leaves your firm susceptible to significant cybersecurity and regulatory dangers. This past July, a U.S.-based IT security software company, KnowBe4, fell victim to the consequences of foregoing advanced verification methods when a North Korean threat actor was hired as an employee.

The foreign threat used “a valid but stolen U.S.-based identity” with an AI-enhanced ID image during their background check, and downloaded extensive malware onto their laptop, threatening the company’s IP. In his report on the incident, the firm’s founder recommends “better vetting” to thwart similar threats.

In another recent case, a man was recently arrested in Tennessee for participating in an illegal program that helped North Korean threat actors pose as U.S. employees. The man, Matthew Isaac Knoot, provided bad actors with U.S. identities, hosted laptop farms on his property, and laundered money for the foreign threat employment scheme. According to Tennessee District Attorney Henry Leventis, Knoot facilitated “a complex, multi-year scheme that funneled hundreds of thousands of dollars to foreign actors.”

As seen in each of these cases, the dangers of foregoing proper ID verification are severe and costly. Without it, firms leave themselves open to significant financial and reputational risk and forego compliance with Anti-Money Laundering (AML), Customer Identification Program, and Know Your Customer (KYC) guidelines. Tampering and third-party actor misuse are prominent risks to U.S. firms, particularly leading up to the 2024 election. Just recently, U.S. IT security company National Public Data experienced a landmark security breach caused by a third-party threat that compromised millions of social security numbers. This is just one example; IBM estimates that a single data breach costs a firm $4.88 million, highlighting firms’ swelling need for more compliant ID storage tools.

Though the financial risks are growing, lost trust is another risk of poor ID verification tools. Consumers are more careful with their data now than ever, with 68% prioritizing protecting their online information. News of breaches instills anxiety in consumers’ minds, causing them to decide who to trust with their information. Robust and comprehensive identity verification tools strengthen companies’ compliance and safeguard them from risk. Luckily, modern innovation provides straightforward solutions to the uncertainty posed by traditional identity verification methods.

How We Can Help: Vcheck’s Innovative Verification Solutions

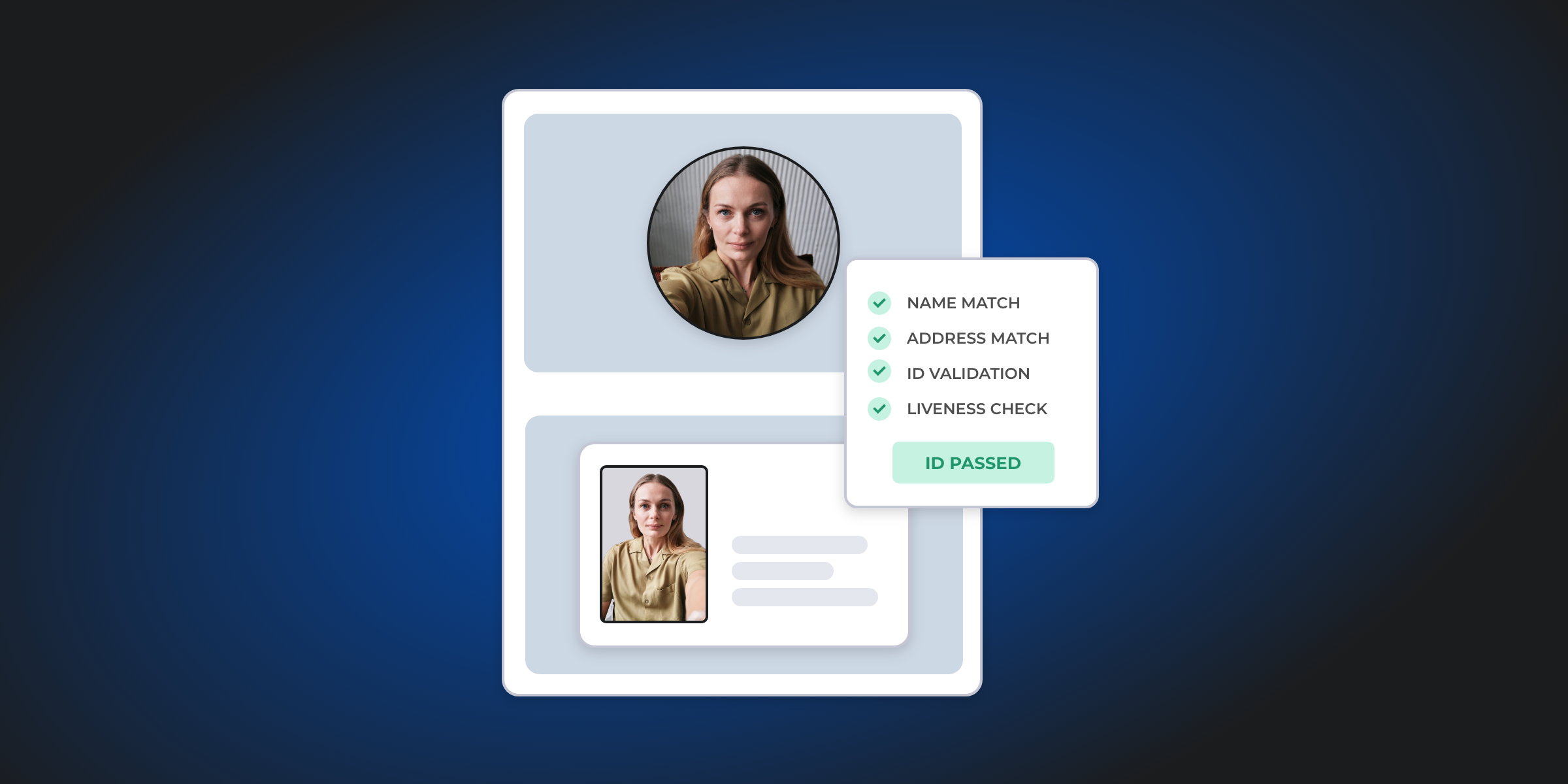

Vcheck recently launched our new ID verification and liveliness solution. Through its unique combination of AI-powered scanning technology and human insight, this tool expedites early parts of the due diligence process, giving our clients access to essential findings in seconds.

Here’s what sets our ID verification solution apart:

- Liveness tools: Liveliness detection uses biometric tools and behavioral analytics to determine whether a person in an image or video is real. Liveliness adds another protective measure to the verification process. It is particularly important to those concerned with insider threats, like KnowBe4, Yahoo, and CashApp, all of which were infiltrated by internal threats over the past two years alone.

- Seamless interface & simplified user experience: Vcheck’s user verification tool allows companies to configure verification thresholds to fit their fraud detection and compliance needs. Our customizable interface view allows firms to maintain a branded experience throughout the hiring and due diligence processes.

- Secure ID storage: Our solution also maintains and safely stores IDs and related information via the Vcheck Portal.

- International Scope: Vcheck’s ID verification solution provides international risk coverage, capable of verifying thousands of unique IDs across 140+ countries and regions.

Unlike other ID verification companies, Vcheck’s ID scanner is heuristic, validating ID authenticity and quality. Quality authentication includes IP address verification, a process that ensures users are where they say they are.

IP address verification is critical to thwart insider threats and bad actors, as was the case when Vcheck found a suspicious ID run by one of our pre-employment clients’ candidates. The candidate was supposedly from Ohio, but our ID verification technology flagged their location information, prompting us to leverage human intelligence and determine the threat.

When our investigators looked into the candidate’s IP address, provided by the live ID image, they learned they were located in China, not the Midwest. Vcheck communicated this information with the client, who was glad they were protected.

This is just one example of how our products safeguard risk. This tool represents a strong step toward a more equitable and robust remote, automated hiring process and more compliant ID storage methods for companies worldwide.

ID Verification Scans: A Key Risk Mitigation Strategy

With countless AI image generation and Photoshop tools at the public’s disposal, the importance of innovating robust ID verification tools is paramount. As technology evolves, businesses must stay abreast of emerging ID verification solutions and best practices to maintain a competitive edge. Along those lines, ID verification is a barrier to fraud, financial crime, and reputational damage.

By implementing robust ID verification and liveliness procedures into your firm’s due diligence process, you can significantly reduce risks, build trust, and comply with regulatory requirements.

Check out Vcheck’s new ID verification and liveliness capabilities and contact us to learn more about how we protect your business.