Investment banking

Mitigating risk for investment banks

Leverage our HUMINT & tech to deliver accurate

risk insights for better investment decisions.

Helping investors navigate emerging risks

Leverage our intelligence solutions for stronger client, partner, supplier, leadership, and employee relationships.

Executive Screening

Corporations and investors rely on us to screen top leadership and vet mutual impact and fit.

Learn more

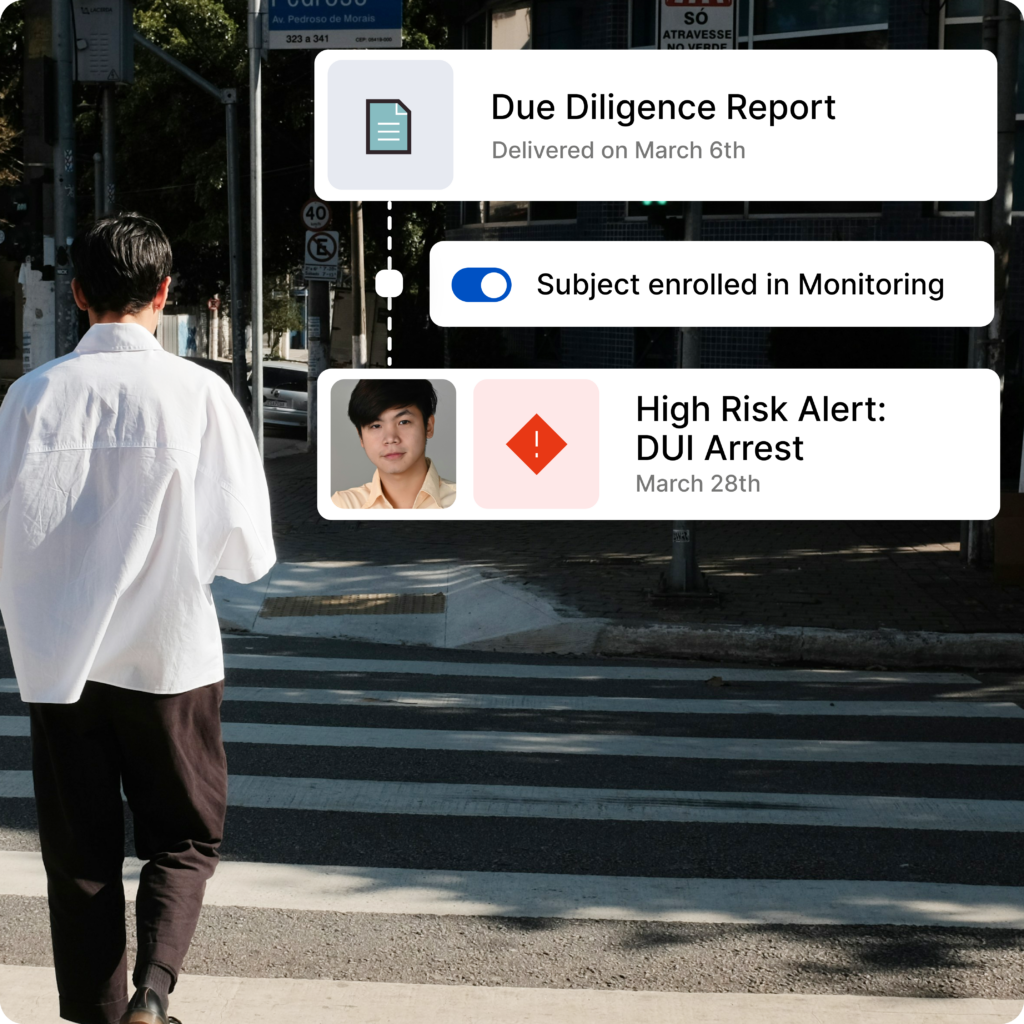

Vcheck Monitoring

Monitor individuals & entities across derogatory news, political exposure, sanctions & enforcements, criminal records, and sex offender registries.

Learn more

Third-Party Vetting

Corporations and global private market investors rely on us to prevent and mitigate third-party risk.

Learn more

Pre-Investment & M&A Due Diligence

Private market investors rely on us to vet investments, executive and senior management placements, and to provide general business intelligence.

Learn more

Public Offerings

Investment banks and law firms rely on us to vet an executive’s past to uncover risks in their personal or professional lives.

Learn more

Know more about your investments

Monitor issuers & investments in real time

Discover our workflow to monitor subjects & entities across derogatory news, political exposure, criminal records, sanctions & enforcements, & sex offender registries.

HUMINT & OSINT for best-in-class risk insights

We combine public records research (OSINT) with the expertise of in-house investigators for capabilities in 150+ countries.

International intelligence for cross-border deals

In-house investigators speak 25+ languages, offering native linguistic & regional familiarity to uncover what others miss.

We search what matters

Search records at the county, state, and federal level.

Cover criminal records at the county, state, and federal level including courts that require a court-runner to obtain comprehensive records.

Verifies subject employment claims and corporate affiliations.

Reveal liens and judgments including county-level liens which require a court runner.

Verify subjects’ education and license claims.

Uncover litigation history and review dockets, complaints, and active cases.

Comprehensive searches of news media and internet information in both English and relevant local languages.

Our investigations team uses subscription-based compliance databases to search hundreds of global watchlists, global security, sanctions, law enforcement, and others.

Screen social media including Facebook, Instagram, X, Linkedin, and blogs to uncover the subject’s online footprint.

Customer success stories

Experienced team,

genuine results

Learn how our clients uncovered reputational & financial

risk with our customizable due diligence workflows.

Frequently asked questions

Generally, 5-7 business days. Timeframe varies depending on deal flow and jurisdiction.

Vcheck uses a comprehensive dual approach, combining advanced public records research with human intelligence. Public records research is a critical first step in our process, used to clarify broader facts about a subject.

When dealing with Politically Exposed Persons (PEPs), financial institutions should:

- Establish clear policies and procedures for PEP relationships

- Conduct enhanced due diligence to understand source of wealth

- Apply more frequent and in-depth transaction monitoring

Ready to dive in?

Take the next step in secure

background checks & investigations.