Search /

All results

-

PACER Data Now Integrated into Vcheck’s Monitoring Providing Real-time Access to Federal Civil, Criminal, and Bankruptcy Filings Now monitoring PACER: Real-time alerts on federal court filings to catch legal risks as they unfold.

PACER Data Now Integrated into Vcheck’s Monitoring Providing Real-time Access to Federal Civil, Criminal, and Bankruptcy Filings Now monitoring PACER: Real-time alerts on federal court filings to catch legal risks as they unfold. -

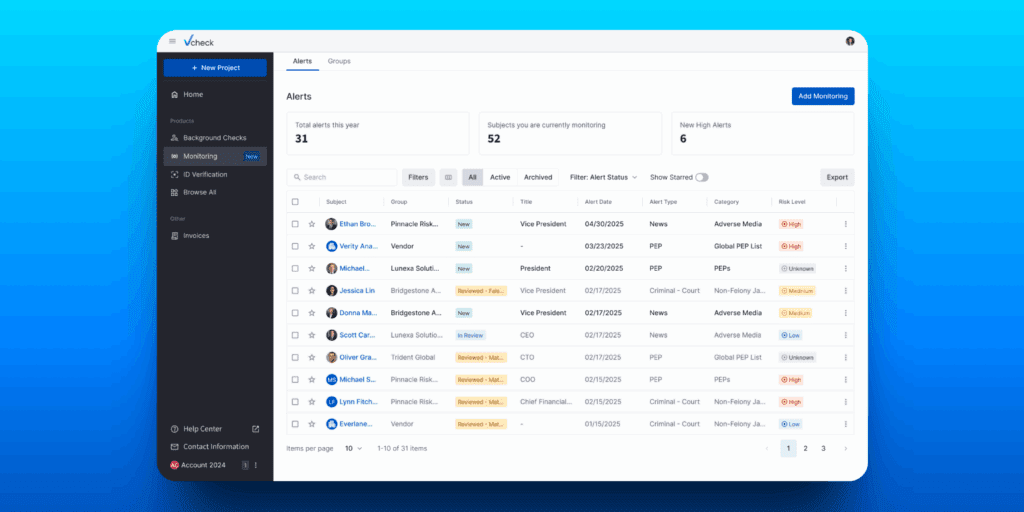

Vcheck’s Monitoring Platform Is Transforming Financial Services Compliance Now live: PACER integration for real-time federal court monitoring—purpose-built for financial services compliance and risk management.

Vcheck’s Monitoring Platform Is Transforming Financial Services Compliance Now live: PACER integration for real-time federal court monitoring—purpose-built for financial services compliance and risk management. -

Tackling the $3.1 Billion Corporate Fraud Problem with Continuous Monitoring Corporate fraud and white-collar crimes disrupt industries and erode public trust.

Tackling the $3.1 Billion Corporate Fraud Problem with Continuous Monitoring Corporate fraud and white-collar crimes disrupt industries and erode public trust. -

Vcheck’s public records research uncovered partnership risks in former professional athlete When a leading private equity firm considered investing in a prominent former athlete’s business, Vcheck’s thorough investigation across 15+ jurisdictions uncovered critical red flags..

Vcheck’s public records research uncovered partnership risks in former professional athlete When a leading private equity firm considered investing in a prominent former athlete’s business, Vcheck’s thorough investigation across 15+ jurisdictions uncovered critical red flags.. -

How FinCEN’s New AML/CFT Rule Reshapes Due Diligence for Investment Advisers Effective January 1, 2026, this rule closes a gap in financial oversight frameworks by classifying IAs as financial institutions under the Bank Secrecy Act (BSA). IAs will now face full AML/CFT compliance for the first time.

How FinCEN’s New AML/CFT Rule Reshapes Due Diligence for Investment Advisers Effective January 1, 2026, this rule closes a gap in financial oversight frameworks by classifying IAs as financial institutions under the Bank Secrecy Act (BSA). IAs will now face full AML/CFT compliance for the first time. -

ExThera Case Exposes Immediate Investor Threat Due to Poor Startup Due Diligence In January 2025, The New York Times published an exposé by John Carreyrou on ExThera Medical, a California startup that allegedly repurposed its FDA-authorized COVID-19 blood filter for cancer treatment without regulatory approval.