Asset management

Smarter investment decisions for asset managers

Discover streamlined human intelligence & advanced technology with real-time investigation management.

Helping asset managers navigate emerging risks

Mitigate risks and ensure compliance with our customizable due diligence workflows

Executive Screening

Corporations and investors rely on us to screen top leadership and vet mutual impact and fit.

Learn more

Vcheck Monitoring

Monitor individuals & entities across derogatory news, sanctions & enforcements, political exposure, criminal records, and sex offender registries.

Learn more

Pre-Investment & M&A Due Diligence

Private market investors rely on us to vet investments, executive talent, and to provide general business intelligence.

Learn more

Fund Manager Screening

Global investment firms, pension funds, and foundations rely on Vcheck to vet fund managers.

Learn more

Third-Party Vetting

Corporations and global private market investors rely on us to prevent and mitigate third-party risk.

Learn more

Litigation Support

Corporations, banks, and law firms rely on Vcheck to carry out pre-litigation due diligence on subjects and targets.

Learn more

Know more about your investments

HUMINT & OSINT for best-in-class risk insights

We combine public records research (OSINT) with the expertise of in-house investigators fluent in 25+ languages (HUMINT), to uncover what others miss.

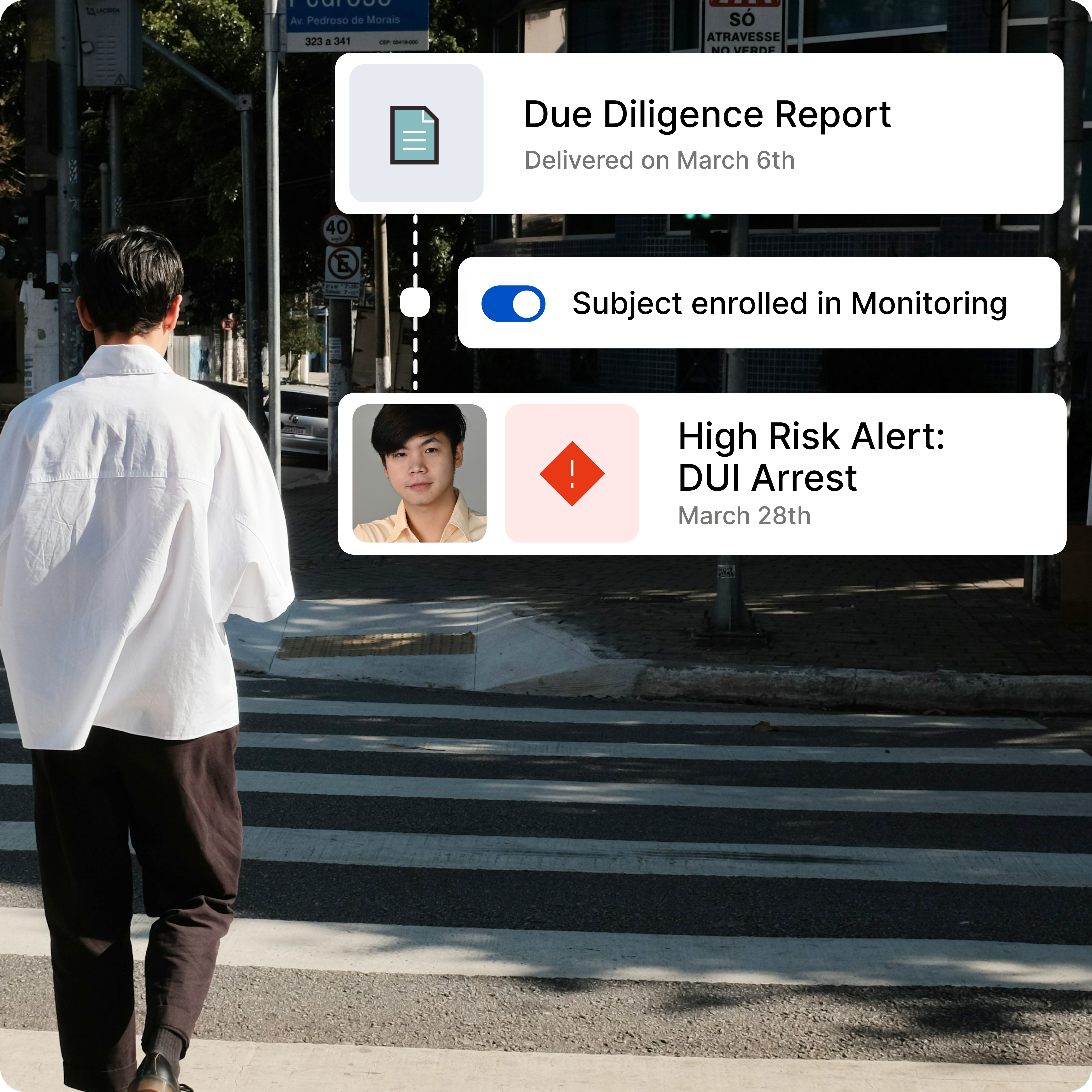

Monitor portfolio companies & third parties

Real-time workflow to monitor subjects & entities across derogatory news, political exposure, criminal records, sanctions & enforcements, & sex offender registries.

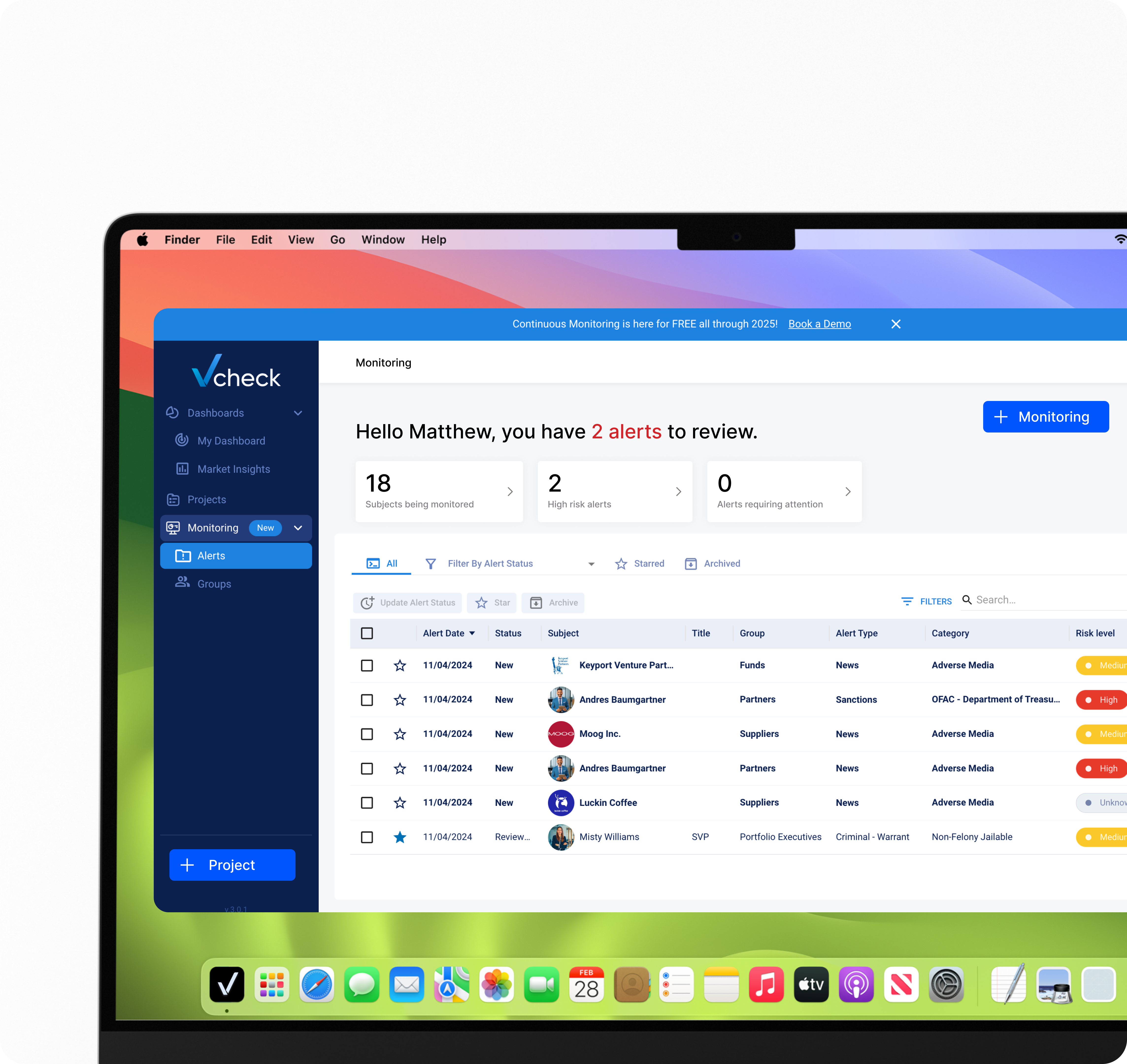

Everything you need at the click of a button

SOC II compliant Platform with robust permission settings & Subject grouping for scaling teams. Intuitive visualizations enable streamlined risk insights and compliance reporting.

We search what matters

Search records at the county, state, and federal level.

Cover criminal records at the county, state, and federal level including courts that require a court-runner to obtain comprehensive records.

Verifies subject employment claims and corporate affiliations.

Reveal liens and judgments including county-level liens which require a court runner.

Verify subjects’ education and license claims.

Uncover litigation history and review dockets, complaints, and active cases.

Comprehensive searches of news media and internet information in both English and relevant local languages.

We use the red flags located in media, litigation, regulatory enforcement, and other public records to inform subject and industry-specific questions in discreet interviews. This provides additional color to public records and can validate or alleviate concerns.

Our investigations team uses subscription-based compliance databases to search hundreds of global watchlists, global security, sanctions, law enforcement, and others.

Screen social media including Facebook, Instagram, X, Linkedin, and blogs to uncover the subject’s online footprint.

Customer success stories

Experienced team,

genuine results

Learn how our clients uncovered reputational & financial

risk with our customizable due diligence workflows.

Frequently asked questions

Generally, 5-7 business days. Timeframe varies depending on deal flow and jurisdiction.

Rigorous due diligence on all investment targets prior to capital deployment helps mitigate risk.

Failing to conduct proper due diligence exposes asset managers to significant losses, reputational damage, and regulatory scrutiny.

Ready to dive in?

Take the next step in secure

background checks & investigations.