Beneficial ownership complicates the due diligence process and poses serious risks to financial institutions. However, identifying beneficial ownership is critical for compliance with anti-money laundering (AML) and FinCEN regulations, raising the stakes for detection.

Updated Legislative Concerns

Before we discuss the implications and specifics of beneficial ownership, it’s important to understand the legislative landscape surrounding the concept: Following concerning and publicized accounts of money laundering and illegality throughout the 2010s, legislators sought to solve risk issues posed by shell companies, passing the Corporate Transparency Act (CTA). The U.S. Chamber of Commerce reports that the CTA will help “prevent individuals with malicious intent from hiding or benefitting from the ownership of their U.S. entities.” In other words, this updated legislation was designed to target shell companies previously exploited by money launderers and terrorism financiers.

Overall, the Corporate Transparency Act, passed in 2021, requires nearly all U.S.-registered and foreign-registered entities doing business in the United States to disclose updated BOI information to the U.S. Treasury Department’s Financial Crimes Enforcement Network, otherwise referred to as FinCEN. There are reporting exceptions for firms with more than 20 employees or greater than $5 million in revenue and those publicly traded.

What is a Beneficial Owner?

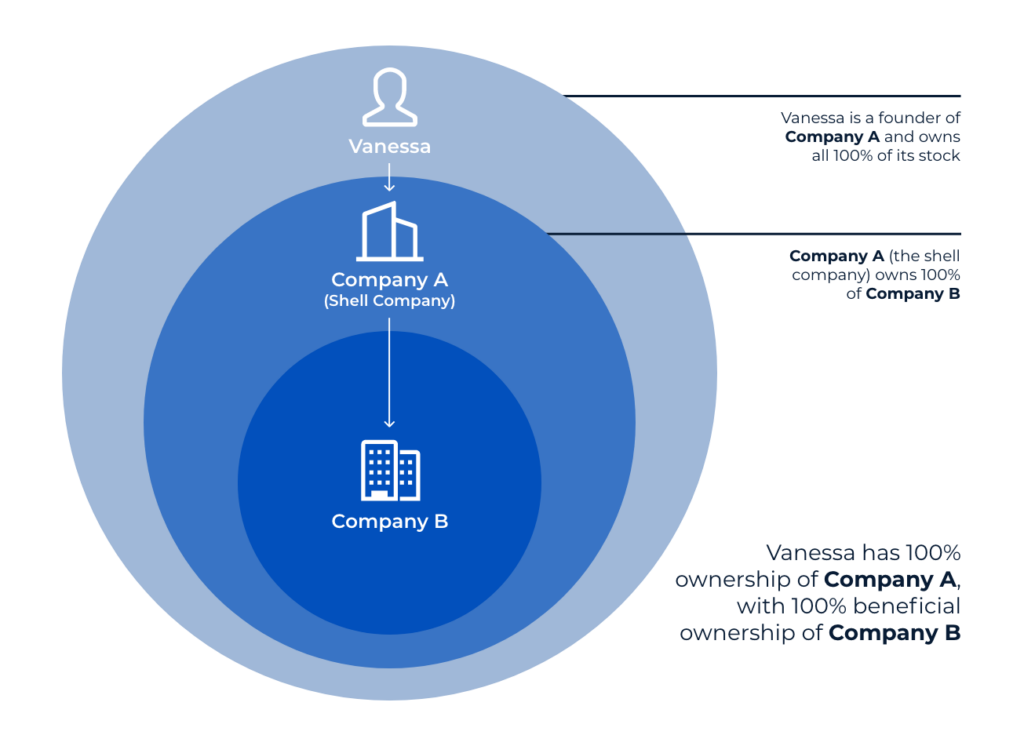

A beneficial owner is an individual or group who enjoys the benefits of owning a company, property, or stock, though the item’s title belongs to another entity. The term could also refer to those (an individual or group) who make decisions on specific securities, investments, or firms.

According to updated FinCEN and AML guidelines, a beneficial owner has a 25% or more stake in a legal entity or corporation. It could also be a group, trust, or someone with a significant role in managing the entities.

While typically one-in-the-same, legal ownership and beneficial ownership are separate ideas. A legal owner might use beneficial owners for many reasons, most of which don’t imply illegality.

For example, publicly traded securities are typically first registered with the broker’s name in the financial industry for convenience. This practice isn’t illegal and is currently recognized by the SEC.

Other cases include high-net-worth individuals and PEPs who wish to protect their assets through a trust while acting as a beneficial owner. More often than not, this is a protective measure to bolster a high-net-worth individual’s privacy. While this practice is legal, it comes with significant caveats.

Beneficial Ownership, Shell Companies, and Risk

Beneficial ownership complicates an organization’s ownership structure, which can sometimes lead to exploitation by malicious actors. The issue is transparency: Transparency is crucial in the financial landscape, and beneficial ownership creates confusion.

Worse is, sometimes, this confusion is merely a cover for illegality. Beneficial ownership isn’t itself risky, but the practice’s ethics are highly contested. Many cite complicated ownership structures as a contributing factor in rising terrorism financing concerns.

Also, critics pinpoint shell companies as a critical risk factor for white-collar crime, which costs the U.S. government $300 million annually. This was the case in the 2021 Pandora Papers leak, which publicized the shell companies and tax evasion tactics of 35 current and former world leaders.

Shell companies are relatively inexpensive and provide corrupt owners with a cover to hide illicitly gained assets or launder money. However, because they’re registered the same way as ‘normal’ companies, they’re nearly impossible to differentiate.

Break Through the Mud: Due Diligence Clarifies Beneficial Ownership

Understanding a company’s ultimate beneficial ownership (UBO) is a critical aspect of due diligence, compliance, and risk management. Unfortunately, obscured ownership structures muddle the due diligence process, and detecting it can be tricky.

Many companies use complex structures couched in multiple layers of ownership, leadership, shell companies, and trusts to obscure the identity of beneficial owners.

Other challenges include jurisdictional issues. Different jurisdictions have varying requirements and standards for disclosing beneficial ownership information, making it more difficult to find complex data.

Also, shell companies complicate due diligence by design: They’re created to conceal ownership and assets, making it more difficult for investigators to uncover the truth.

Skilled investigators can determine beneficial ownership in several key ways. For example, a recent case study highlights the use of human source inquiries to uncover beneficial ownership for a Libyan oil firm. But human intelligence (HUMINT) is just one example; Vcheck’s investigators leverage the following to determine beneficial ownership specifics:

- Public records research: Our investigators search corporate registries, securities filings, and court records to find associations between business entities. They also use database aggregators to find public records critical for determining a Subject’s background.

- Domain Registration Information: Vcheck’s investigators determine corporate ownership through digital footprint tools like Google Analytics, which can evaluate linked websites, thus uncovering complicated ownership. WHOIS lookups can provide further information about domain registrants, linking sites with the same owner and pinpointing true leadership and other associations.

- Financial Transaction Analysis: Leveraging age-old wisdom, Vcheck’s investigators follow the money, analyzing financial transactions and payment flows to reveal hidden connections and patterns.

- Social Media & Red Flag Media Searches: A company’s social media following can be telling; profiles, directories, and posts can help investigators determine connections between leadership or other firms.

By combining these methods, companies can comprehensively understand their business networks, identify potential risks, and ensure compliance with regulatory requirements.

Financial Due Diligence Considerations

Understanding a company’s beneficial owners helps create transparency and mitigates the risk of white-collar crime and investment fraud. Furthermore, a proactive approach fosters a culture of transparency and accountability within our broader financial system.

Shell company and beneficial ownership due diligence deter bad actors from hiding behind complex ownership structures to conduct illicit activities. Pinpointing beneficial owners helps firms assess risks associated with a given business relationship, enabling them to perform more thorough due diligence.

Contact us to learn more about how Vcheck identifies complex ownership structures.