VCHECK AT A GLANCE

Human-Led, Technology-Enabled

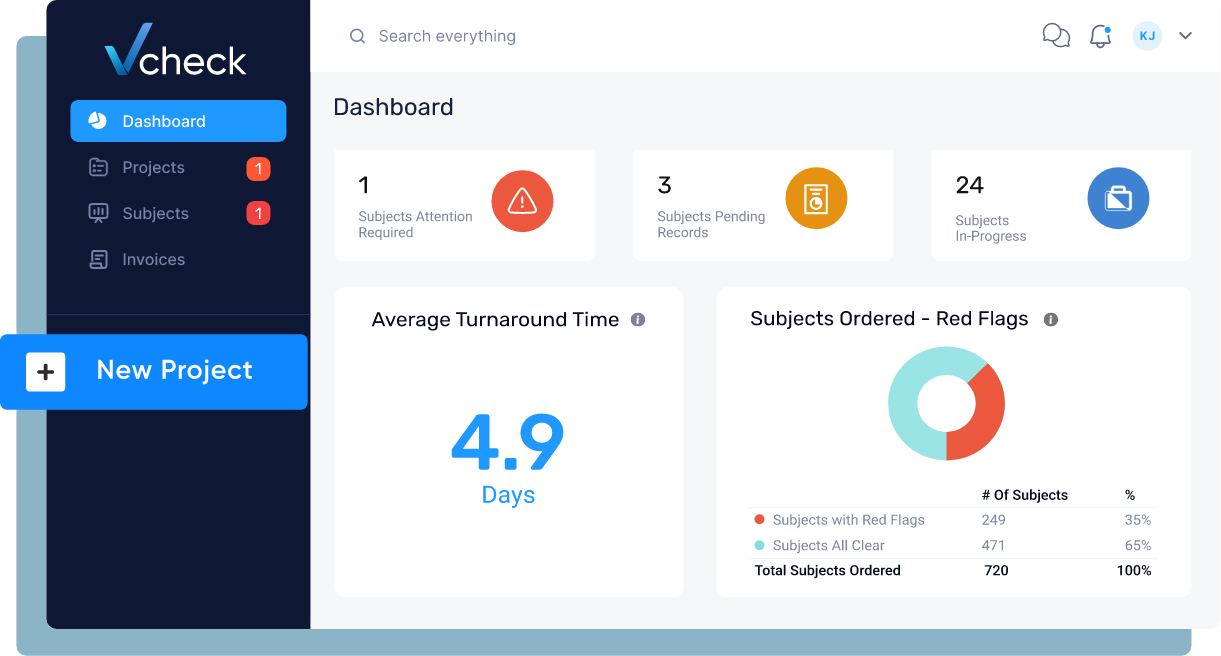

Everything you need at a click of a button

- Order, track, and retrieve reports

- Securely transfer documents

- Configure user permissions by product

- View a breakdown of red flags by subject

Get world class support whenever you need it

- Live chat with customer success team

- Receive ETAs on court runners and document retrieval

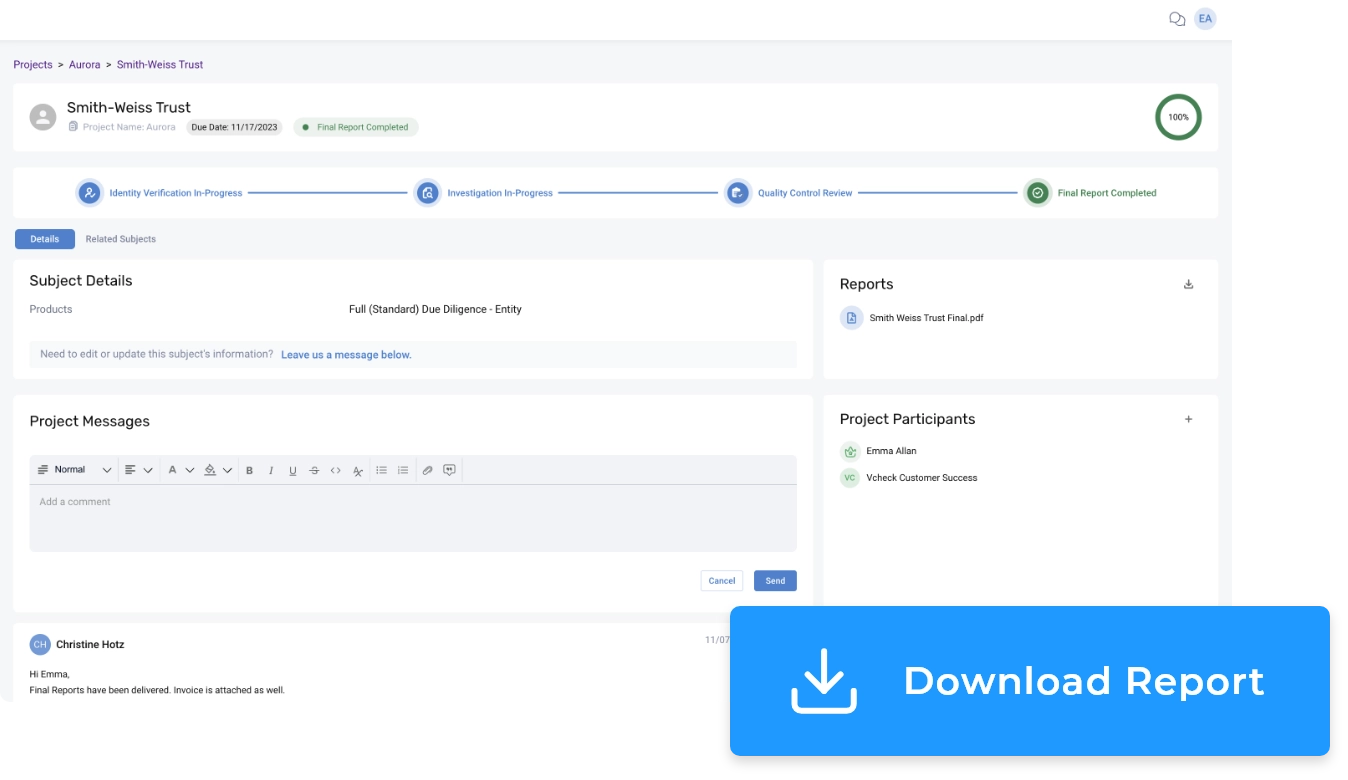

- Track the status of reports

- Collaborate with team members

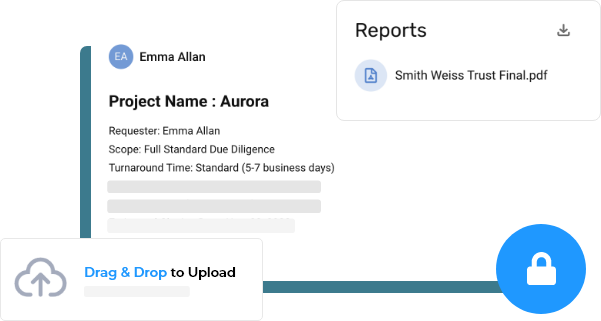

Prioritizing the security and protection of our customers’ sensitive data

- Best-in-class security infrastructure

- Data encrypted at rest and in transit

- Strict access controls to ensure that only authorized personnel have access to data

Everything you need at a click of a button

- Order, track, and retrieve reports

- Securely transfer documents

- Configure user permissions by product

- View a breakdown of red flags by subject

Get world class support whenever you need it

- Live chat with customer success team

- Receive ETAs on court runners and document retrieval

- Track the status of reports

- Collaborate with team members

Prioritizing the security and protection of our customers’ sensitive data

- Best-in-class security infrastructure

- Data encrypted at rest and in transit

- Strict access controls to ensure that only authorized personnel have access to data

2000+

Clients serviced

75+

In-house investigators

15

Languages in-house

Committed to customer success.

All clients are assigned a dedicated account team that understands your process, scope and goals.

Live Chat

Collaborate in real time with our customer success team via live chat on our portal.

OUR CAPABILITIES